A Kadir Jasin

UPDATE, Aug. 30 - Former Bank Negara Malaysia (BNM) deputy governor, Tan Sri Lin See Yan, testified that he only spoke with Datuk Seri Anwar Ibrahim about the central bank’s currency trading losses from the 1990s, and not the prime minister then.

He also told the Royal Commission of Inquiry’s (RCI) hearing on the BNM losses today that he was never requested to discuss the matter with Tun Dr Mahathir Mohamad.

Lin said that Anwar, who was then Dr Mahathir’s deputy as well as finance minister, was “most unhappy” when informed about the losses allegedly incurred and had agreed that BNM should close any open positions to limit its exposure.

I am not aware if anyone else informed the prime minister about the forex losses incurred by BNM,” he said.

Lin also described the late Tan Sri

Jaffar Hussein, who was the governor of BNM when the forex losses happened, as

an “honourable man”.

“I remember what he said to me was:

I got this bank into this mess and I will fix it,” he said.

Lin said that Jaffar was “too trusting”

with the individuals who operated the forex trading on behalf of BNM.

Original Post

THE ROYAL Commission Royal Commission to Enhance the Operations and Management of the Royal Malaysian Police took more than a year to complete its work.

|

| The Dzaiddin Commision took more than a year to complete |

It was commissioned by (Tun) Abdullah Ahmad Badawi in

2004, when he was Prime Minister. It was headed by the former Chief Justice of

Malaya, (Tun) Mohamed Dzaiddin Abdullah.

The Royal Commission Royal on the Bank Negara foreign

exchange (forex) trading losses has three months to complete its task. It is

the handiwork of the Prime Minister, (Datuk Seri) Mohd Najib Abdul Razak.

It is

headed by the former Chief Secretary to the Government and the current Chairman

of Petronas, (Tan Sri ) Mohd Sidek Hassan.

[REMINDER. Anonymous comments will not be published.]

One year vs three months and Dzaiddin vs Mohd Sidek.

Dzaiddin took more than a year to come up with 125 recommendations and Mohd

Sidek took a handful of days to conclude that someone would be charged as a

result.

The Dzaiddin commission was to find the truth and fix the

problems. Mohd Sidek’s commission was to dig up something that happened 30

years ago and had been attended to.

|

| The Sidek Commission has three months to complete its task |

The former was for the better good of the country. The

later looks and smells like a political witch hunt to discredit the growing opposition

to the Umno-BN government.

Dzaiddin spent much of his career on the bench. He was

assisted in the commission by a former Lord President (Tun Salleh Abbas), the

former IPG (Tun Haniff Omar), a high court judge, the Bar Council Chairman, a

senior lawyer, a journalist, an academic, a former opposition MP, a social activist

and head of a think tank.

Mohd Sidek on the other hand is an administrator. He is assisted by high court judge (Kamaludin Md Said), Bursa Malaysia chief executive officer (Tajuddin Atan), co-chairperson of the special task to facilitate business (Saw Choo Boon), accountant and former Ernst & Young partner (K. Pushpanathan) and Finance Ministry’s strategic investment department secretary (Yusof Ismail).

Readers and debaters of this blog can judge for

themselves the vast differences between the two RCIs.

The Murad Factor

For the protagonist of the Forex commission, the former Bank Negara Assistant Governor, (Datuk) Murad Khalid, his is self preservation cloaked in the name of truth and justice.

A close friend of his, who is a good friend of mine, told me that he was seeking to “clear his name”.

But why now – 17 years later? Does he truly believe that he can ride on the gullibility of the Najib Administration to achieve his personal goals?

Murad hit the spotlight when, on 6 Nov 2000, he was fined RM500,000 or in default six months jail by the Kuala Lumpur Sessions Court.

According to an Utusan Malaysia report, he was found guilty of failing to declare shares and properties belonging to his company.

|

| An Utusan Malaysia report about Murad being fined |

He

pleaded guilty to the charge of failing to provide accurate particulars of the

shares of Ben Harta Sdn Bhd and 51 properties worth about RM24 million at Bank

Negara Malaysia, Jalan Dato Onn, at 11.56am on Aug 20 1999.

The Ben

Harta shares were held by his nominees, Gan Hong Sing @ Lan Hong Sing and Gor

Sor Ting. Murad was surprisingly wealthy for a salaried person working for Bank

Negara.

It is recalled that Murad had made a statutory declaration accusing

(Datuk Seri) Anwar Ibrahim of corruption. It was investigated by the

Anti-Corruption Agency (ACA), the forerunner to the MACC, and was found to be

baseless.

Murad had appeared before the commission and implicated

Anwar once again. Anwar had responded via a press statement dated August 24

asking to appear before the commission to rebut Murad’s charges.

Other Players

Apart from Murad, other important players from Bank

Negara were (Tan Sri) Nor Mohamed Yakcop, who was in charge of the forex

department during the period, and the late (Tan Sri) Jaffar Hussein, who was the

governor.

But always bear in mind that although Bank Negara is a

government institution, it operates independently of the government. It even

determines its own salary scheme.

It was on this basis that (Tan Sri) Zeti Akhtar Aziz, when

she was the governor, recommended that 1MDB be charged for flouting forex rules

in relation to the transfer of billions of ringgit in and out of the country.

But it was turned down twice by Najib’s Attorney General, (Tan Sri) Mohamed

Apandi Ali.

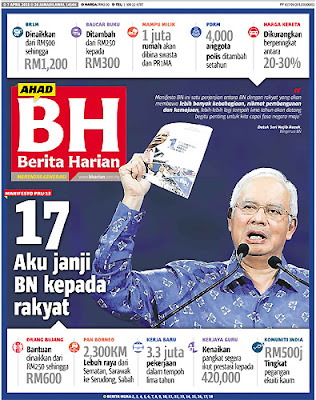

|

| Apandi holding his "infamous" charts cleared Najib of 1MDB scandal |

During the 1997/98 Asian Financial Crises, its then

governor (Tan Sri) Ahmad Mohd Don and deputy governor, (Datuk) Fong Weng Phak, opposed

the exchange control proposal by then Prime Minister, (Datuk Seri) Dr Mahathir

Mohamad. They resigned in protest.

And since currency trading, being one of the most

specialised of Bank Negara’s activities, it could not have been the day-to-day

concern of any Prime Minister or Finance Minister.

In the case of the 1990’s forex activities, the key

player was Nor Mohamed. He was blamed for the losses and was removed from the

bank. But the person who ultimately paid the price was then governor, the late

Tan Sri Jaffar Hussein. He took full responsibility for the losses and

resigned.

Every central bank worth its salt dabbles in currency

trading to protect its national currency and, in some instance, to make profit.

Bank Negara is no exception and, on occasions, it did make profit.

But there had been cases of rogue currency traders

getting intoxicated on their cloak and dagger game with hedge funds that they

gambled away billions of dollars of their banks’ money.

Incidentally, at about the same time that Nor Mohamed was

playing up the Bank Negara forex trading, an American bank, Allfirst Bank was shifting

its forex operations from a merely hedging endeavor to one that would yield

profits and boost its bottom line. It hired a little known currency trader by

the name of John Rusnak.

According to reports, Rusnak seemed adept at matching

options with forward contracts to hedge against risk. He bet on the yen and

lost a total of US$691 million. His bank was robust enough to take the losses

but he was found guilty and sentenced to seven and a half years in prison plus

a fine of US$1 million.

For years before the

debacle, Bank Negara was seen as an active player in the currency market mainly

to protect the value of the ringgit as part of its role as the custodian of the

monetary system. Monetary stability is one of two key objectives of Bank

Negara.

Who Would Be Blame?

Nor Mohamed is by all account the main figure. He is the

man at the centre of the storm. The most convenient way out for him is to blame

Jaffar. After all Jaffar had solely accepted the blame.

But I don’t think Nor Mohamed would do that. It’s too

convenient and would not go down well with the public. He’s more likely to

point fingers at the former Prime Minister, Tun Dr Mahathir Mohamad, and at Anwar.

That’s what Najib wants. But that would make him an

absolute traitor to the man who gave him his life back. Had it not been for Dr

Mahathir, he would have remained a pariah in the financial world.

Instead, for telling Dr Mahathir how those billions were

lost, he was appointed Dr Mahathir’s Special Economic Adviser and was partially

credited with implementing the exchange control during the 1997/98 Asian

Financial Crises.

Obviously Dr

Mahathir and Anwar are very important witnesses. Both men had said they love testify. The question is would the Commission dare to call them.

I am not surprised if they are not called. The whole idea

of having the commission could be blown to bits should the two men testify.

The dilemma for the Commission is, whether or not it

calls Dr Mahathir and Anwar, the two men could go public with their side of the

story elsewhere.

I don’t envy Mohd Sidek and his merry men. They are

squeezed between a rock and a hard place.

They are professional people whereas the

whole idea of the RCI is political. No matter what they come up with, their

credibility and professionalism will be put to question.

Most Malaysians don't even know or care about the event when it happened 30 years ago because it did not cause them hardship nor put the country's finances in jeopardy. The losses were acknowledged and steps were taken to amortized them over a period of time.

On the contrary, Bank Negara reserves declined more drastically between June 30, 2014 and June 30, 2017 - from US$131.86 billion to US$98.92 billion - representing a drop of US$32.94 billion.

Was it due to attempts to protect the ringgit, paying debts, capital outflow or a more sinister reason? Whatever the case is, Bank Negara never sleeps. Forex activity is a 24-hour business.

Wallahuaklam.